Page 7 - documentation_package

P. 7

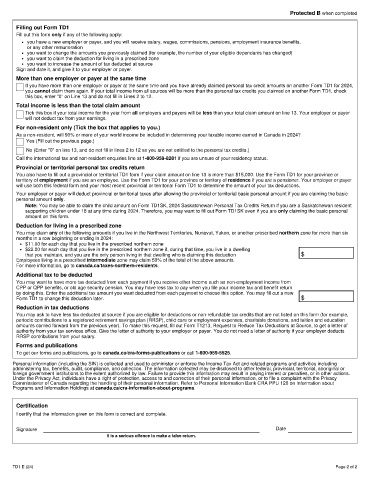

Protected B when completed

Filling out Form TD1

Fill out this form only if any of the following apply:

• you have a new employer or payer, and you will receive salary, wages, commissions, pensions, employment insurance benefits,

or any other remuneration

• you want to change the amounts you previously claimed (for example, the number of your eligible dependants has changed)

• you want to claim the deduction for living in a prescribed zone

• you want to increase the amount of tax deducted at source

Sign and date it, and give it to your employer or payer.

More than one employer or payer at the same time

If you have more than one employer or payer at the same time and you have already claimed personal tax credit amounts on another Form TD1 for 2024,

you cannot claim them again. If your total income from all sources will be more than the personal tax credits you claimed on another Form TD1, check

this box, enter "0" on Line 13 and do not fill in Lines 2 to 12.

Total income is less than the total claim amount

Tick this box if your total income for the year from all employers and payers will be less than your total claim amount on line 13. Your employer or payer

will not deduct tax from your earnings.

For non-resident only (Tick the box that applies to you.)

As a non-resident, will 90% or more of your world income be included in determining your taxable income earned in Canada in 2024?

Yes (Fill out the previous page.)

No (Enter "0" on line 13, and do not fill in lines 2 to 12 as you are not entitled to the personal tax credits.)

Call the international tax and non-resident enquiries line at 1-800-959-8281 if you are unsure of your residency status.

Provincial or territorial personal tax credits return

You also have to fill out a provincial or territorial TD1 form if your claim amount on line 13 is more than $15,000. Use the Form TD1 for your province or

territory of employment if you are an employee. Use the Form TD1 for your province or territory of residence if you are a pensioner. Your employer or payer

will use both this federal form and your most recent provincial or territorial Form TD1 to determine the amount of your tax deductions.

Your employer or payer will deduct provincial or territorial taxes after allowing the provincial or territorial basic personal amount if you are claiming the basic

personal amount only.

Note: You may be able to claim the child amount on Form TD1SK, 2024 Saskatchewan Personal Tax Credits Return if you are a Saskatchewan resident

supporting children under 18 at any time during 2024. Therefore, you may want to fill out Form TD1SK even if you are only claiming the basic personal

amount on this form.

Deduction for living in a prescribed zone

You may claim any of the following amounts if you live in the Northwest Territories, Nunavut, Yukon, or another prescribed northern zone for more than six

months in a row beginning or ending in 2024:

• $11.00 for each day that you live in the prescribed northern zone

• $22.00 for each day that you live in the prescribed northern zone if, during that time, you live in a dwelling

that you maintain, and you are the only person living in that dwelling who is claiming this deduction $

Employees living in a prescribed intermediate zone may claim 50% of the total of the above amounts.

For more information, go to canada.ca/taxes-northern-residents.

Additional tax to be deducted

You may want to have more tax deducted from each payment if you receive other income such as non-employment income from

CPP or QPP benefits, or old age security pension. You may have less tax to pay when you file your income tax and benefit return

by doing this. Enter the additional tax amount you want deducted from each payment to choose this option. You may fill out a new

Form TD1 to change this deduction later. $

Reduction in tax deductions

You may ask to have less tax deducted at source if you are eligible for deductions or non-refundable tax credits that are not listed on this form (for example,

periodic contributions to a registered retirement savings plan (RRSP), child care or employment expenses, charitable donations, and tuition and education

amounts carried forward from the previous year). To make this request, fill out Form T1213, Request to Reduce Tax Deductions at Source, to get a letter of

authority from your tax services office. Give the letter of authority to your employer or payer. You do not need a letter of authority if your employer deducts

RRSP contributions from your salary.

Forms and publications

To get our forms and publications, go to canada.ca/cra-forms-publications or call 1-800-959-5525.

Personal information (including the SIN) is collected and used to administer or enforce the Income Tax Act and related programs and activities including

administering tax, benefits, audit, compliance, and collection. The information collected may be disclosed to other federal, provincial, territorial, aboriginal or

foreign government institutions to the extent authorized by law. Failure to provide this information may result in paying interest or penalties, or in other actions.

Under the Privacy Act, individuals have a right of protection, access to and correction of their personal information, or to file a complaint with the Privacy

Commissioner of Canada regarding the handling of their personal information. Refer to Personal Information Bank CRA PPU 120 on Information about

Programs and Information Holdings at canada.ca/cra-information-about-programs.

Certification

I certify that the information given on this form is correct and complete.

Signature Date

It is a serious offence to make a false return.

TD1 E (24) Page 2 of 2