Page 4 - documentation_package

P. 4

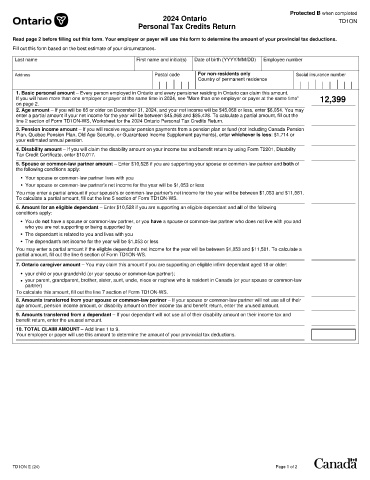

Protected B when completed

2024 Ontario TD1ON

Personal Tax Credits Return

Read page 2 before filling out this form. Your employer or payer will use this form to determine the amount of your provincial tax deductions.

Fill out this form based on the best estimate of your circumstances.

Last name First name and initial(s) Date of birth (YYYY/MM/DD) Employee number

Address Postal code For non-residents only Social insurance number

Country of permanent residence

1. Basic personal amount – Every person employed in Ontario and every pensioner residing in Ontario can claim this amount.

If you will have more than one employer or payer at the same time in 2024, see "More than one employer or payer at the same time" 12,399

on page 2.

2. Age amount – If you will be 65 or older on December 31, 2024, and your net income will be $45,068 or less, enter $6,054. You may

enter a partial amount if your net income for the year will be between $45,068 and $85,428. To calculate a partial amount, fill out the

line 2 section of Form TD1ON-WS, Worksheet for the 2024 Ontario Personal Tax Credits Return.

3. Pension income amount – If you will receive regular pension payments from a pension plan or fund (not including Canada Pension

Plan, Quebec Pension Plan, Old Age Security, or Guaranteed Income Supplement payments), enter whichever is less: $1,714 or

your estimated annual pension.

4. Disability amount – If you will claim the disability amount on your income tax and benefit return by using Form T2201, Disability

Tax Credit Certificate, enter $10,017.

5. Spouse or common-law partner amount – Enter $10,528 if you are supporting your spouse or common-law partner and both of

the following conditions apply:

• Your spouse or common-law partner lives with you

• Your spouse or common-law partner's net income for the year will be $1,053 or less

You may enter a partial amount if your spouse's or common-law partner's net income for the year will be between $1,053 and $11,581.

To calculate a partial amount, fill out the line 5 section of Form TD1ON-WS.

6. Amount for an eligible dependant – Enter $10,528 if you are supporting an eligible dependant and all of the following

conditions apply:

• You do not have a spouse or common-law partner, or you have a spouse or common-law partner who does not live with you and

who you are not supporting or being supported by

• The dependant is related to you and lives with you

• The dependant's net income for the year will be $1,053 or less

You may enter a partial amount if the eligible dependant's net income for the year will be between $1,053 and $11,581. To calculate a

partial amount, fill out the line 6 section of Form TD1ON-WS.

7. Ontario caregiver amount – You may claim this amount if you are supporting an eligible infirm dependant aged 18 or older:

• your child or your grandchild (or your spouse or common-law partner);

• your parent, grandparent, brother, sister, aunt, uncle, niece or nephew who is resident in Canada (or your spouse or common-law

partner)

To calculate this amount, fill out the line 7 section of Form TD1ON-WS.

8. Amounts transferred from your spouse or common-law partner – If your spouse or common-law partner will not use all of their

age amount, pension income amount, or disability amount on their income tax and benefit return, enter the unused amount.

9. Amounts transferred from a dependant – If your dependant will not use all of their disability amount on their income tax and

benefit return, enter the unused amount.

10. TOTAL CLAIM AMOUNT – Add lines 1 to 9.

Your employer or payer will use this amount to determine the amount of your provincial tax deductions.

TD1ON E (24) Page 1 of 2