Page 5 - documentation_package

P. 5

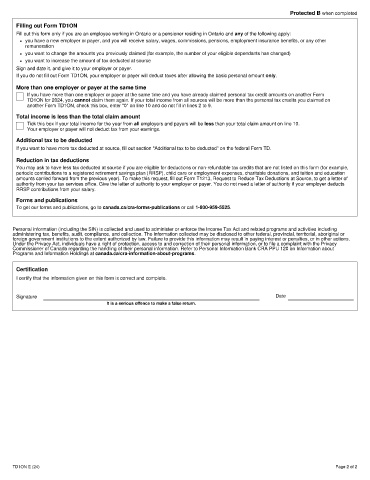

Protected B when completed

Filling out Form TD1ON

Fill out this form only if you are an employee working in Ontario or a pensioner residing in Ontario and any of the following apply:

• you have a new employer or payer, and you will receive salary, wages, commissions, pensions, employment insurance benefits, or any other

remuneration

• you want to change the amounts you previously claimed (for example, the number of your eligible dependants has changed)

• you want to increase the amount of tax deducted at source

Sign and date it, and give it to your employer or payer.

If you do not fill out Form TD1ON, your employer or payer will deduct taxes after allowing the basic personal amount only.

More than one employer or payer at the same time

If you have more than one employer or payer at the same time and you have already claimed personal tax credit amounts on another Form

TD1ON for 2024, you cannot claim them again. If your total income from all sources will be more than the personal tax credits you claimed on

another Form TD1ON, check this box, enter "0" on line 10 and do not fill in lines 2 to 9.

Total income is less than the total claim amount

Tick this box if your total income for the year from all employers and payers will be less than your total claim amount on line 10.

Your employer or payer will not deduct tax from your earnings.

Additional tax to be deducted

If you want to have more tax deducted at source, fill out section "Additional tax to be deducted" on the federal Form TD.

Reduction in tax deductions

You may ask to have less tax deducted at source if you are eligible for deductions or non-refundable tax credits that are not listed on this form (for example,

periodic contributions to a registered retirement savings plan (RRSP), child care or employment expenses, charitable donations, and tuition and education

amounts carried forward from the previous year). To make this request, fill out Form T1213, Request to Reduce Tax Deductions at Source, to get a letter of

authority from your tax services office. Give the letter of authority to your employer or payer. You do not need a letter of authority if your employer deducts

RRSP contributions from your salary.

Forms and publications

To get our forms and publications, go to canada.ca/cra-forms-publications or call 1-800-959-5525.

Personal information (including the SIN) is collected and used to administer or enforce the Income Tax Act and related programs and activities including

administering tax, benefits, audit, compliance, and collection. The information collected may be disclosed to other federal, provincial, territorial, aboriginal or

foreign government institutions to the extent authorized by law. Failure to provide this information may result in paying interest or penalties, or in other actions.

Under the Privacy Act, individuals have a right of protection, access to and correction of their personal information, or to file a complaint with the Privacy

Commissioner of Canada regarding the handling of their personal information. Refer to Personal Information Bank CRA PPU 120 on Information about

Programs and Information Holdings at canada.ca/cra-information-about-programs.

Certification

I certify that the information given on this form is correct and complete.

Signature Date

It is a serious offence to make a false return.

TD1ON E (24) Page 2 of 2